Last week, a Texas State Representative made herself look pretty damn stupid.

From United Press International:

TERRELL, Texas, April 9 (UPI) -- A Texas legislator defended her comment that Asian-descent voters should adopt names that are "easier for Americans to deal with." Republican state Rep. Betty Brown of Terrell, 32 miles east of Dallas, said through a spokesman her comment was not racially motivated but was an attempt to solve problems with identifying Asian names for voting purposes.

During a hearing Tuesday night, Brown responded to testimony from Ramey Ko, a representative of the Organization of Chinese Americans. He had said people of Chinese, Japanese and Korean descent often have problems voting because their legal transliterated name is often different from their common English name used on their driver's license and on school registrations, the Houston Chronicle reported.

"Rather than everyone here having to learn Chinese -- I understand it's a rather difficult language -- do you think that it would behoove you and your citizens to adopt a name that we could deal with more readily here?" said Brown, whose comments were posted on YouTube Thursday.

Read On

Over the weekend, Ms. Brown rethought her comments, or at least her political future, and

apologized.

While it's easy to say that Ms. Brown is an ignorant, minority view, the fact of the matter is that I'm sure there are a great deal of people who agree with her. Brown's spokesman said that

90% of Texans want a voter ID law, an idea which, to me, reaks of being anti-minority. Whether that number is correct or not remains to be seen. 90% is a very high number. But even if the number is off, I wouldn't be surprised if Brown really was speaking for her constituency in at least some sense.

America is the melting pot of the world. It has a black president. But to think that all corners of the country are progressive and colorblind is far from true.

This issue of Asians changing names hits very close to home for me. My fiancee, 耿倩, is going to be changing her name later this year after we get married. While she's pretty sure what that name will be, what she's going to go by on a daily basis is open to some debate.

耿倩 in pinyin (romanized Chinese) is Geng Qian. "Geng" is the third tone and "Qian" the fourth. Chinese family names come first and given names second. So Geng is the family name, Qian her given name.

Chinese people call her either Geng Qian, Qian, or Qian Qian. Qian Qian is a kind of cutesy nickname that friends or family call her.

I don't call her any of these things. I call her "Jackie." Jackie is the English name she chose when she was in high school. There was no particular reason why she chose that name. Just something she liked. She's not sure, but it may have had something to do with Jackie Kennedy and liking her. Jackie has never claimed to be a Jacqueline shortened to Jackie. She's just Jackie.

I met Jackie when working at an English training school. She was a Chinese English teacher and I was a foreign English teacher. In that environment, every Chinese teacher goes by their English name. No foreign teacher at that school knows any of the Chinese teachers' Chinese names. In fact, many of the Chinese teachers don't even know the other Chinese teachers' names. There's no real need to learn them.

So while I was teaching at the school, I worked with a bunch of Chinese people who I only knew by their English names: Kristy, Jane, Tiger, Doris, Bernice, and, of course, Jackie.

Seeing that my relationship with my fiancee was largely based out of the English training school environment we were involved in, I always referred to her as Jackie. I still do. In the two years we've dated, I've never made a concerted effort to stop calling her "Jackie" and to begin using her Chinese name. There just hasn't been any reason to. She fine with what I call her (I've asked) and so am I.

Being from Kansas City in middle-America, I figured that when we eventually go to America one day, she could just be Jackie. While I really like her Chinese name, we are already in the groove of using Jackie and I reckoned that it would just be easier for Americans to wrap their heads around.

Qian is actually a beautiful name. In terms of Chinese names/sounds, I think it's one of the best. To hear what it sounds like, click

here. As you can see, it sounds kind of like "Chee" and "An" put into one syllable. To me, Qian sounds a lot better than some other Chinese sounds that I hear all the time. Sounds such as Dong, Wang, or Chang.

When back home this past Christmas, I had a conversation with my mom, Aunt, and female cousin. We were talking about "Jackie" when they asked me what her real name is. I told them "Qian." They all thought it sounded so great and that she should use that when she comes to America. I agreed that it is a nice name but explained that being spelled Qian, I could imagine infinite amount of mispronunciations and difficulties with the name. I wasn't sure if it would be worth the effort. The family members I was talking with, a group of relatively conservative midwestern women, all assured me that it isn't too difficult and that they loved it.

This was pretty surprising to me. I previously had thought that they'd be the type of people with the biggest problem with the name. But in fact, they gave Qian a ringing endoresement.

I told Jackie about the rousing response Qian got back home. She was pleased to hear that. She said, "Well, why don't I just use that when I go to the US?" I had no problem with this and have no problem with it now. Although I'm sure that her transition from Jackie to Qian, if she does indeed go forward with it, will be hardest for me more than anyone else seeing that she's been Jackie to me for the past two plus years.

I'm fine with going for it if it is indeed what she decides to do upon going to America.

If anyone is still reading this ridiculously long post, I'd be curious what you think about Qian Jacqueline and what name she should go by in America. Will Qian be too much trouble for Americans who have no idea the Q in Qian should sound like a CH? Will this be a lot of headaches for her? Would it be better for her to make Betty Brown proud and just be Jackie?

No matter what she does, I hope that Jackie/Qian can have as little contact with ignorant people such as Betty Brown as possible. People who think that being "Qian" as opposed to "Jackie" is somehow un-American don't seem to, in my opinion, have a very good understanding of what The United States of America really is.

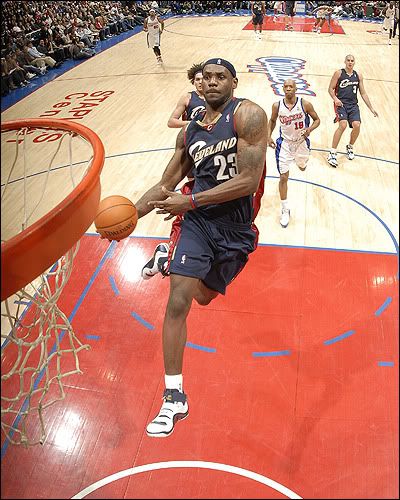

According to multiple sources within the Cavs, franchise majority owner Dan Gilbert has a tentative agreement in place to allow a group of Chinese investors to purchase a significant stake in the Cavaliers Operating Company, the entity that owns the Cavs and operates Quicken Loans Arena. The group is led by JianHua (Kenny) Huang, a Chinese businessman who has become successful by linking American and Chinese companies.

According to multiple sources within the Cavs, franchise majority owner Dan Gilbert has a tentative agreement in place to allow a group of Chinese investors to purchase a significant stake in the Cavaliers Operating Company, the entity that owns the Cavs and operates Quicken Loans Arena. The group is led by JianHua (Kenny) Huang, a Chinese businessman who has become successful by linking American and Chinese companies.  "This has recently happened again. As has been done previously, we're in the process of reviewing the possibility presented to us. Beyond that, we do not feel it would be appropriate to give further comment at this time."

"This has recently happened again. As has been done previously, we're in the process of reviewing the possibility presented to us. Beyond that, we do not feel it would be appropriate to give further comment at this time."

"It's this perfect, beautiful island of people who are immensely motivated, going to great high schools," marveled Parke Muth, director of international admission at U-Va.

"It's this perfect, beautiful island of people who are immensely motivated, going to great high schools," marveled Parke Muth, director of international admission at U-Va.